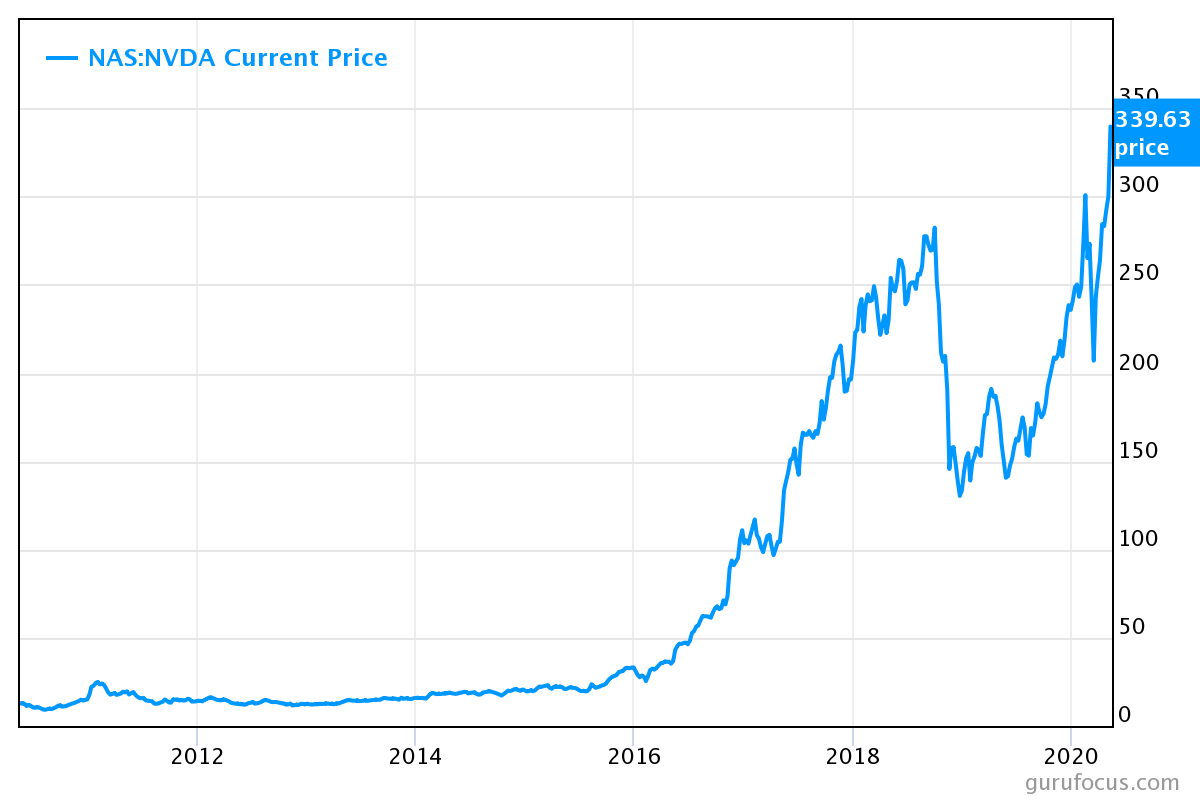

If the dominant factor is the change in RPS then it means the company has performed better or worse than expected - leading to corresponding share price corrections however, the company's expected margin of profitability in the future has not necessarily changed significantly so there may not be a significant accompanying change in the P/S ratio expectations. NVDA 122.20 -5.16 -4.05 : NVIDIA Corp - MSN Money Key Ratios Income Statement Balance Sheet All Per Share Values Growth Rates Profitability Valuation Leverage & Liquidity Efficiency Quarterly Per. When Revenue per share (RPS) is Dominant Factor NVIDIA Price to Free Cash Flow Ratio 2010-2022 NVDA Prices Financials Revenue & Profit Assets & Liabilities Margins Price Ratios Other Ratios Other Metrics PE Ratio P/S Ratio Price/Book Ratio Price-FCF Ratio Net Worth Historical price to free cash flow ratio values for NVIDIA (NVDA) since 2010.

NVIDIA annual revenue for 2022 was 26.914B, a 61.4 increase from 2021.

If the dominant factor is the change in P/S ratio then it means there has been a significant change in investor perceptions of future profitability for the company even though recent past financial performance has not reflected the change in perceptions.P/S ratio increase (multiple expansion) = higher expectations of future profits (typically at a higher margin than before) P/S ratio decrease (multiple contraction) = lower expectation of future profits (typically at a lower margin than before) NVIDIA revenue for the twelve months ending Jwas 29.738B, a 35.81 increase year-over-year.

The dominant factor - P/S Ratio or Revenue per share - accounts for what drove the stock price change since the end of 2018.

0 kommentar(er)

0 kommentar(er)